2019 Forecast

Once again time to pull out the old crystal ball for the 3rd edition of our annual Nanaimo real estate market forecast...Well not exactly…From day 1 the Jahelka Real Estate Group has prioritized delivering value-added content, a true advisory approach in a largely transaction driven business, where we make use of our formal education, training, and experience working with hundreds of buyers and sellers of real estate, to produce information and interpretation of the market to help keep you fully informed as a buyer, seller, investor or observer of the real estate market in the Harbour City. In our technology-driven society, anyone can report statistics, however, it is in the interpretation of these statistics and understanding how they may impact your personal circumstances, goals, and objectives, that defines a true advisory approach to the provision of real estate services. Curious about how we did on our 2018 Forecast? Check out our 2018 Recap where we take a look at some of our results.

For the first time in a number of years, there is some uncertainty surrounding our real estate market in Nanaimo. While market timing is nearly impossible, there are signs and symptoms that do give us reasonable insight into the health of the market. I would equate this to going to a doctor for a check-up. They can’t predict the number of days that you have left, but they can rely on their years of formal education and experience to reasonably accurately determine if you are generally in good health. They will also use their training to identify major risks that could drastically shorten your life expectancy such as the discovery of a tumour or clogged major arteries, before setting out a prescribed set of actions to best deal with the situation. Working with an educated, experienced Realtor is actually quite similar, as they will be able to navigate you through the inevitable ups and downs of the market over time, ensuring you are fully informed and well positioned to minimize your downside risk while being well positioned to benefit when opportunities present themselves. If you are contemplating making a move in the year ahead, in a market where you have nearly 400 realtors to choose from, you have a lot of choice. Heading into uncertain times, more so than in years past, this choice will matter. An interesting nuance with our industry is that by and large, most realtors/brokerages charge a similar rate of commission for their services. This just isn’t the case in most other professional service industries. Imagine a scenario where you could hire the top lawyer in town to represent you in a legal case or you could hire his most junior associate who is on his first day on the job, for the same cost. There wouldn’t even be a question about who you would go with. For many, real estate will be the largest asset they ever hold, so the stakes are high. You deserve to stay informed, and whether you work with us or not, as the market shifts, please align yourself with trusted advisors who will put your interests first at all times, and bring with them the qualifications, proven results, and a solid understanding of the market required to best position you for success.

Real Estate Cycles

While it may come as a surprise to those who have entered the market over recent years, real estate markets do actually go in cycles, it is not all up, all the time. While some of the circumstances impacting these cycles differ from cycle to cycle, the constant is there is always a cycle… Stagnation (economic slowdown), recovery where increased consumer demand starts to eat through the excess inventory from the past market top, credit-fueled expansion where lenders are more freely financing new developments, speculative market top where new entrants to the development game jump in late and overbuild late in the cycle, correction where supply exceeds demand and lenders tighten up lending policies, back into stagnation again ...repeat. While market cycles are a near certainty, what isn’t is the duration of any one cycle. While there are some consistent factors that influence market cycles such as interest rates, lending policies, demographics, employment levels, population change, etc., there are also new influences each cycle which can have an impact. One such factor in the most recent upswing is technology. Social media has forever changed how information is shared, speeding up the rate of information dissemination immensely. Real estate marketing has changed, whereby buyers can now virtually walk through a home online with the click of a mouse, or conduct a short facetime walk-through with their agent, viewing properties from the comfort of their own homes. Writing offers, done online as well through various e-signature platforms. In the information age, real estate markets which historically have been very localized have been opened up, whereby we have out-of-market, and in some cases, out-of-country buyers purchasing real estate sight unseen. What does this all mean? Well, our take is that the speed and ease of transacting in real estate, and the increased spotlight social media and other modern methods of information sharing has placed on the industry is likely to accelerate the speed at which cycles take place, whilst also increasing volatility, as industry players can react much quicker to new information. In a market largely driven by greed and fear, heightened exposure about strong real estate returns and speculators jumping in magnify the impact of the market boom. On the flip side, negative or pessimistic media coverage and social sharing, and fear can very quickly cool a market. When we start to look at next cycle innovations and influences, we see financial technology or “fintech” drastically changing the lending landscape. While we won’t get into details in this report, we see that this will further serve to speed up cycle times and volatility.

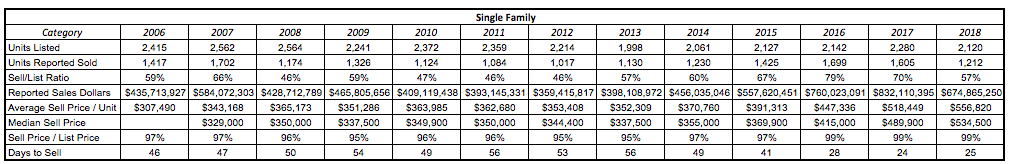

Alright, so what does all of this cycle talk have to do with the 2019 Forecast? Well, since real estate cycles have been a constant, it is our belief that looking at the past cycle in our local market could provide some insight into what could be in store moving forward. For those new to the area or too young to remember, here is a brief snapshot of the single-family housing market in Nanaimo dating back to 2006.

Based on factors such as sales volume, sell/list ratio, and average home price increases, after a number of positive years, we see 2007 as the previous cycle market top. Following this, 2008 had some similarities to a decade later in 2018, which followed what in our view was this cycle’s market top in 2017. In 2008, average home prices were up 6.4%, similar to the 7.4% average increase in 2018. However, both sales volume and sell/list ratio took a fairly major step down in both years. 2018 saw sales volume drop 24.4%, which was the largest year-over-year volume drop since the 31% in 2008. The sell/list ratio dropped from 70% to 57% in 2018. In 2008 it was a decrease to 46% from 66%.

So what happened in 2009? The number of listings dropped nearly 13%, sales volume went up nearly 13%, the sell/list ratio rebounded to 59%, the average sale price was down 3.8%, median price was down 3.6%, the sell price/list price dropped to 95%, and the average days on market increased 8%.

Over the next 4 years, the market experienced a prolonged slowdown. Average home sale prices remained relatively flat, as following the -3.8% result in 2009, there was a 3.62% increase in 2010, followed by decreases of -0.36% and -2.56% in 2011 and 2012, and -0.31% in 2013. During this period sales volume fell well below the 10-year average, bottoming out in 2012 with 1,017 single-family home sales. For those homes that did sell, the sell price/list price ratio was in the 95-96% range, and average days on market was in the 49-56 day range. From 2010 to 2012, the sell/list ratio hovered between 46% and 47%, before the market started to show some signs of renewed life in 2013 with a sell/list ratio of 57% on the heels of a cycle low in units listed (1,998).

2014 signalled the transition into the recovery phase of the cycle which prevailed for the better part of the next 2 years, where we saw sales volume increase, the sell/list ratio hit 60% and 67% respectively, average sales prices increased 5.24% and 5.54%, and the sell price/list price increased to 97%, with both years experiencing significant decreases in average days required to sell. 2016 and 2017 represented the credit-fueled expansion phase of this cycle. Money was cheap (low interest rates) and lending policy was looser, with financing more readily available than it had been during the prolonged slowdown. In both of these years, sales volume was well above the 10 year average, the sell/list ratio was above 70%, home values were soaring with average sale prices rising 14.32% in 2016 and 15.90% in 2017, the sell price/list price was 99% and the average days on market was below 30, reaching the cycle low in 2017 at 24 days. From later 2017 onwards, we see the market reaching this cycle’s speculative top. Those who have sat on the sidelines and watched others reap the rewards of participating in a strong market are now jumping in as investors and “wannabe” developers. Construction costs are skyrocketing, build quality is dropping, and lending policy is tightening. Sophisticated investors and experienced developers are starting to unload their inventory, managing their downside risk to a market correction. With double-digit price appreciation becoming the “new normal”, sellers’ expectations have never been higher and homes are being overpriced, as inexperienced realtors who have only participated in an upmarket validate the unrealistic expectations of sellers by taking overpriced listings, resulting in the first significant decrease (24.4%) in sales volume, back down below the 10-year average with the sell/list ratio dropping.

While we have discussed the market action for single-family homes for illustrative purposes, we also track similar statistics for lots, apartment condos, townhomes, patio homes, etc., and would be more than happy to answer cycle related questions pertaining to any of these real estate categories.

Leaving 2018, this provides the perfect segue into our forecast of what is to come in 2019 and beyond.

Here’s our take on what is to come:

Demand

While there are some key drivers that impact demand, it is important to remember that there are “macro” drivers which seem to impact the broader market, and there are the “micro” drivers which are much more focused and poised to impact certain locations, categories of real estate, or price points more so than others. At different points during the cycle, real estate markets will be driven more by either the macro-market influences where values across all categories or locations tend to move in the same direction or conversely by micro-market influences where real estate market performance is going to see increased variance by category or location. While we expect that there will be some macro influences, we see the 2019 real estate market in Nanaimo being more influenced by micro influences than has been the case over the past number of years, where basically all categories and areas saw values soar across the province, like a rising tide taking everything in its path along for the ride.

Drilling down to focus on the Nanaimo market, we reference the 2017 VIREB Buyer’s Survey, which is the most telling resource available to provide insight into what was driving demand at the peak of the current market cycle. The survey detailed that 64.2% of buyers in 2017 moved from other communities, 56.7% new to Nanaimo, and 7.5% returning after living away. So where did these buyers come from? 27.9% from the Lower Mainland and 12.3% from Victoria, making a reasonable assumption that affordability challenges and the relative value offered in Nanaimo was likely a key consideration for those roughly 40% of buyers making the move from the Lower Mainland or Victoria. A further 19.2% moved from elsewhere on Vancouver Island, 12.3% from other areas in BC, and 19.2% from other areas of Canada. It would be reasonable to assume that affordability and value was not a primary motivator for the move for these 50.7% of buyers from these areas as outside of a few markets (Toronto, Okanagan, etc.), Nanaimo’s average price would have actually been similar or higher than most other markets in Canada. The survey indicated that 4.9% of purchases were made by international buyers, so the international influence was probably not as strong as the underlying belief that foreign buyers were significantly impacting demand in the area. Diving deeper into buyer motivation for purchasing and the survey revealed that 54.6% of buyers were purchasing their retirement residence, whereas only 15.4% of buyers were first time home buyers, where mortgage financing and qualification amounts are significant influences on demand at various price points and for certain categories of real estate.

If you read our 2017 Forecast and 2018 Forecast, we talked a fair bit about pent up demand, that was unmet by subdued inventory levels. It was this pent up demand and lack of supply which was driving the rapid price increases in our market. It is our take that this pent-up demand has largely been satisfied, and that some buyer demand from those looking to move from other markets has dissipated based on changing macro market conditions, where there is no longer an underlying fear of buying now in the area to lock up their retirement residence before prices get out of reach.

While we see more balanced market conditions moving forward, Vancouver Island is increasingly being sought as the retirement destination of choice for Canadians across the country. With about half of the out-of-town buyers coming from areas where affordability was not likely the primary motivator of the move, and 54.6% of buyers purchasing their retirement residence, make no mistake, the demographic behemoth known as the baby boomers are poised to provide sustained demand in the area over the next decade which should serve to insulate our area more so than others from any rapid price decreases or major corrections. Retiring baby boomers are also less likely to require mortgage financing to make their purchases, so with interest rates expected to return to more normalized (higher) levels over the next number of years, the negative impact on buyer purchasing power should not be as pronounced as it would be in other markets where demand is primarily driven by those in their working years and heavily reliant on maximizing mortgage qualification amounts to participate in the market.

As we mentioned in the opening of this section, from a performance perspective, we would expect more differentiation among categories of real estate and price points.

Starting with categories, we see sustained demand over the next decade for low-maintenance, stratified properties catering to local empty nesters entering retirement and those increasingly seeking out Central Vancouver Island as their retirement destination of choice. Ranchers and unique lifestyle properties on golf courses or near marinas, as well as homes that are manageable size-wise in terms of square footage but are complemented by sizeable storage capacity, especially large detached garages (where the baby boomers can store all of their “stuff”), should all see fairly sustainable demand.

Looking at price levels, it is important to consider that demand varies at different price levels and for different asset classes. Starting with price levels, Nanaimo has experienced average single-family home price increases of 14% in 2016, 16% in 2017 and 7% in 2018. When you consider that the most recent census indicated that the median household income in Nanaimo is $62,822, with an average total income of $76,942, and with mortgage qualification becoming increasingly challenging with the stress tests that have been put in place, it is inevitable that at some point you hit a wall where regardless of whether or not buyers would like to purchase at a certain price level, prospective buyers are simply unable to qualify for it. Right now millennials are in their household formation years, which should be driving demand from first-time home buyers. Yet, in 2017, only 15.4% of purchasers were first-time buyers. With Nanaimo still transitioning from a primarily blue-collar economy to more of a serviced-based, retail economy setting up to serve the baby boomers in their retirement years, the job market in Nanaimo simply doesn’t provide the types of jobs and income required to support families buying homes that would adequately meet their space needs. For illustrative purposes, we used RateHub.ca’s Mortgage Affordability Calculator in a scenario where a buyer had a downpayment of $25,000, property taxes were $3,000 per year, and heating costs were $150 per month, with no significant consumer debt, at the Bank of Canada’s current qualifying rate of 5.34% to see what the median and average household incomes in Nanaimo would qualify for.

The calculator indicates that the median household income in Nanaimo would qualify for a mortgage of $287,609, and the average household income would qualify for a mortgage of $349,456. Yes, you read that right. The median household income in Nanaimo would qualify for a mortgage $287,346 less than the average home price in the city… This is assuming the buyer has no other debt, but in the World’s most indebted nation, how many citizens of Nanaimo with a household income of $62,822 have no debt, or the additional $287,609 in cash readily available to use merely to purchase what amounts to an average home? Homeowners who have been in the market a while and who rode this cycle upwards resulting in substantial home equity that they could turn over, maybe; first time home buyers and young families just getting established, no chance. Make no mistake, this will have a significant impact on demand and ultimately housing prices. We see this as the number one headwind the Nanaimo housing market currently faces as the largest block of our population is the baby boomers, many of whom are now empty nesters living in the 3,000+ square foot homes they bought in the $200,000 - $300,000 range a 10 to 15 years ago, that are now valued well beyond the grasp of the average household in town based on income qualification. With that said, we see constrained demand for single detached family homes that wouldn’t typically appeal to retiring baby boomers, especially those priced beyond $600,000, many of which are in the 3,000+ square foot range that empty nesters are trying to unload to enjoy their retirement.

One category that we are bullish on long-term is acreages. Land is still relatively cheap in our area relative to the Lower Mainland, and land is in short supply in close proximity to larger urban centers. With increasing densification in the city and smaller and smaller lot sizes, we see that the next market upswing should see solid demand from those with the financial means and those moving from out of town for 2-5 acre properties. Larger acreage and farm properties within a half hour drive from Central Vancouver Island communities, especially if there is any rezoning potential will likely also be in high demand.

Supply

It should be an interesting year on the supply side of the equation. As noted in our 2018 Recap, there were 7% fewer listings in 2018 than 2017. However, sales volume dropped 24.4% with the sell/list ratio decreasing to 57% from 70% in 2017. What is also important to mention is that with such a notable drop in sales volume, active inventory levels throughout most of the year were higher than they were in the same month in 2017. With an increased number of homes that had listings expired as a result of owners overshooting on their listing price and who were unwilling to price at a level that would have brought buyer interest, it will be interesting to see if sellers disappointed that they may have missed a market top choose to sit on the sidelines, or whether we will see their homes back on the market with more realistic sales prices, which should be well received by buyers constrained by mortgage qualification amounts.

Looking at the downsizing baby boomers, when considering a move their primary driver is likely lifestyle where they are trying to ease the burden of cleaning and maintaining the 5-bedroom, 3,000+ square foot house, in favor of the 1,600 sqft. stratified property that will free up significant time to enjoy retirement. A significant percentage of these potential sellers will be mortgage free, and those that aren’t but who have spent a decade or more in their current homes will have bought at much lower price levels so mortgage payments should be fairly reasonable, meaning that affordability should not be a significant motivator to possibly chase a market down to meet buyer demand constrained by mortgage qualification levels of families needing the space. This would be putting them in a position where they are “selling low” so that they can “buy high” in what we see will be a competitive market for senior-oriented, single story retirement housing options and lifestyle properties by the golf course or marinas. Being so ripe out of a major market upswing, we see that in the foreseeable future, sellers tied to “what they could have sold for in 2017” are likely to remain content where they are. Looking out a couple of years, if price growth remains relatively muted and reality starts to set in, aging baby boomers will likely reach a breaking point where maintaining a large home and yard is no longer in the cards, at which time inventory levels for these larger homes will rise.

Getting late in the cycle, we typically see an oversupply of new construction. While savvy developers carefully monitor market conditions and adjust accordingly to mitigate their risk exposure, those new to the development game or those new to the Nanaimo market may be overexposed. With a number of multi-family projects either under construction or pre-construction, those that have not pre-sold or that are not located in ideal locations may run into trouble as we see an oversupply of new units hit the market in the next couple of years. Without getting into specifics, there are a few projects on the horizon where we feel out-of-town developers may have missed the mark, failing to understand consumer preferences, stigmas that are associated with certain areas, and the reality that real estate is cyclical and so if you haven’t got your project off the ground and out-of-town buying from working-age professionals with incomes to support their price levels has dried up, then you are not going to be able to obtain unsupported, record prices in a market where excessive supply will likely force price decreases to move inventory as lender pressure mounts due to an overall market slowdown. While we hope we are wrong and downtown is rejuvenated largely on the back of the new development that is changing the real estate landscape in the area, we are definitely cautious on our outlook over the next few years for multi-family new construction. Referencing the past cycle, the market for apartment style condos in Nanaimo was hit much harder than the single-family market, and it happened quickly. From 2008 to 2009, the average days on market increased 41% and average sales prices dropped 9%. From 2010 to 2014, average sale prices declined every year, with the sell/list ratio range from 30% to 38%, clearly a buyer’s market. From the peak of the last cycle in 2007 where we had a sell/list ratio of 65%, it took 8 years to eat through the oversupply of condos to return to a similar sell/list ratio and average sales price reminiscent of previous cycle highs. So what happened in 2009 to precipitate this prolonged slowdown? On the heels of the 2008 great recession, developers in Nanaimo threw caution to the wind and initiated construction on 345 condo units, more than double the average number of condo starts over the past decade. So how many condo starts did we have in 2018? 247, a new cycle high, and the most since you guessed it, 2009.

I know, it is different this time. Vancouver has just discovered Nanaimo...on and on the story goes. A word of caution here… I have had more than one conversation with experienced real estate players in this city who have been through multiple cycles who have told me that in each and every cycle we reach a point where “Vancouver has discovered Nanaimo” and ultimately this provides a false sense of security for new developers who think the underlying demand will be there to support their project despite what market conditions are suggesting. While we hope we are wrong about this, please, please take caution and carefully evaluate the risk potential of any new projects that are being undertaken at this stage in the cycle.

Looking at single-family home starts, we saw 255 in 2018, which is actually below the 10-year average and nearly 28% lower than the 354 in 2017 representing a cycle high. Builders of single-family homes appear to be more nimble and appear to have reacted to shifting market conditions. There are currently 64 new homes on the market in Nanaimo, 14 of which are priced under $600,000, 35 between $600,000 - $799,999, 12 between $800,000 - $999,999, and 3 over $1,000,000. With resale listing inventory still relatively light for single-family homes, there doesn’t appear to be any risk of oversupply based on numbers for single-family new construction. However, with elevated construction costs persisting, the question is whether builders will be able to price to be competitive enough with the resale market (not subject to GST, and without additional costs such as landscaping, in some cases appliances, blinds, etc.). If builders have anticipated shifting market conditions and can price competitively and still hit their margins, then they should fair ok. If construction costs have most builders stretching on price, then we will likely see inventory levels start to pile up. Builders considering taking on additional new builds in the coming year should be cautious in monitoring absorption and construction costs this spring, to determine how they should best play this market in the short term. Those building for the high end of the market should be cautious due to affordability challenges that continue to restrict buyer demand.

Interest Rates

Dating back a couple of months, it seemed that 3 rate hikes in 2019 were almost a foregone conclusion. However, with overall economic growth forecasts for 2019 in Canada being adjusted downward as a result of oil production restrictions in Alberta and concern over the housing market-related industries which would be impacted by a significant slowdown, expectations have very quickly adjusted course to the point where there is talk that a rate cut is nearly as likely as a rate hike as the next move made by the Bank of Canada. With subdued growth and concerns about the housing market, we would expect the Bank of Canada to remain cautious, carefully monitoring numbers and adjusting course as necessary. Given the uncertainty, we feel there is a very reasonable case that could be made to support the next interest rate move heading in both directions. Should the housing market slowdown, which has been magnified by increased media coverage and social sharing and which is still impacted by the B-20 mortgage qualifying stress test inhibiting affordability, become more of an extreme correction than anticipated, having more of a drag of Canadian economic performance than expected, we would likely see no movement in rates or a move downward with rates. However, should the mandated restrictions on oilfield production have the intended outcome and assuming the housing market doesn’t have any major negative surprises in store, our take is that we are likely to see the next move by the Bank of Canada be an increase in their overnight lending rate likely in the second or third quarter of this year. Again, sentiment has shifted so quickly so this is a tough call to make. However, without any major surprises, we see rates by year’s end likely 25, but possibly 50 basis points higher if economic growth surprises to the upside, as the Bank of Canada works towards their objective of normalizing rates over the next few years.

With the 5-year bond yield noticeably declining since November, RBC just this week was the first big bank to decrease their 5-year fixed rates. While in the short term other lenders will likely follow suit, should the situation in the oilfield improve and the impact of the housing market slowdown not escalate further leading to improved overall economic growth expectations, we should see 5-year bond yields increase, likely sending 5-year fixed rates higher by at least 25 basis points by year’s end. As mentioned above, we see the Bank of Canada likely increasing overnight lending rates, which will trigger prime rate and ultimately variable rate mortgage increases by years’ end. With that said, we are not expecting any significant movement here this year, as at this stage we are unlikely to see a repeat of 2018 where the Bank of Canada hiked rates 3 times.

Government Intervention

The B-20 mortgage stress tests likely had a more significant impact on cooling the housing market than was initially intended. Provincially, the expanded foreign buyer tax and speculation tax also played a role in quickly cooling overheated real estate markets. Governments should understand the significant role the housing/construction industry plays in the Canadian economy, as the single largest economic driver in 7 of 10 provinces. Governments also have a vested interest in keeping the economy strong as a thriving economy translates into a thriving tax base. With this being the case, we see 2019 as a year governments will likely keep a close eye on the housing market, but are unlikely to make any knee jerk reactions in the short term. This watch-and-see approach is more likely to translate into policy changes in 2020 and could be a hot topic of debate leading up to the federal election this fall.

Other Markets

For buyers coming from out of town, Nanaimo is always being compared to other markets and affordability plays a huge role here. The Greater Vancouver market is really the “straw that stirs the drink” in our provincial housing market. With year-over-year volume (all property types) in December down 44%, and average home prices declining in the 10% range, with some suggesting certain areas and price points could be down as much as 25%, the Vancouver market which led the market upswing is being hit hard and there is reason to believe there is further pain ahead, as affordability has just gotten so far out of reach for most buyers. With our recent boom driven largely by demand from the Lower Mainland and Victoria buyers, who represented more than 40% of buyers in Nanaimo in 2017 at the peak year of this cycle, we see that short term, much of this demand will dissipate. Lower Mainland buyers are waking up to negative reports about the housing market almost daily, and the market overall is in somewhat of a fearful state. Buyers previously priced out of their local markets are seeing declining prices possibly back into their buying range, and multiple offers are no longer frustrating buyers, and enabling sellers to cash out at ridiculous premiums, setting the stage for a move to the island to live mortgage free. With all that said, we see those driven to move to Nanaimo in large part due to affordability which we estimate was 25% to 35% of peak market buyer demand, will be a relative non-factor in the year or two ahead. Translation, 25% to 35% of buyer demand has likely evaporated.

However, demand from out-of-town buyers should remain fairly consistent for those driven by lifestyle design who are looking at a move to the Island for its climate, recreational opportunities, and increasing infrastructure as a retirement destination of choice. Market conditions will not stop the demographic wave that is the baby boomers hitting their peak retirement years. We see Nanaimo and Central Vancouver Island outpacing other areas in terms of inter-provincial and intra-provincial migration, which should serve to support demand, especially for ground-oriented housing options and lifestyle properties on golf courses and near marinas, all of which should be attractive to baby boomers looking to enjoy the island lifestyle in retirement.

Listing Volume

The number of new listings in 2018 was 7% less than we saw in 2017, however, due to a 24.4% decrease in sales volume, the average month’s ending inventory was higher than it was in 2017, providing more choice for buyers. We see single-family listing volumes remaining in a fairly tight range relative to the 2018 numbers, likely in the +/- 10% range. Referencing the past cycle, the largest year-over-year change in listing volume came in 2009, where listing volume was down 12.6%.

Sales Volume

On the heels of a 24.4% decrease in single-family sales volume, dropping below the 10-year average, we see volume possibly rebounding slightly as sellers who were unable to sell possibly becoming more realistic with their pricing, and overall market sentiment and media coverage of our shifting market likely influencing sellers to be more realistic when pricing a property if they are serious about selling. A rebound from 1,212 units this year up towards or slightly above the 10-year average of 1,285 would be the expectation here, contingent on sellers being more realistic this year when pricing their homes. Should sellers continue to dream that they will get “what their neighbour sold for in 2017”, especially in higher-priced neighbourhoods where demand was driven by affordability-motivated out-of-town buyers which has largely dissipated, we could see sales volume decrease.

Patio home volume should remain strong, driven by demand from retirees. Other categories typically see a slowdown as the market starts to cool, so similar or slightly declining volume could be reasonably expected in 2019.

Sales Price

The price growth increase for single-family homes decelerated in 2018 to 7.4% from 15.9% in 2017 on lower volume and a lower sell/list ratio. With expectations of lower affordability driven demand from out-of-town buyers, more realistic seller pricing leading to a slight increase in sales volume, we see the sell price/list price ratio likely declining from 99%, as sellers will likely need to be more willing to negotiate to secure a sale than in years past. Should all of this occur, we see average prices being relatively flat this year, most likely in the +/- 2.5% range. Should a more drastic correction take hold provincially or nationally, we could see average prices decline year-over-year for the first time since 2013.

Homes priced above $750,000 are more vulnerable to falling values as affordability related constraints will continue to limit demand for homes priced in this range.

Upward pressure on pricing will likely remain for homes in high demand from downsizing baby boomers locally and those choosing to retire here from other areas of the country. Ranchers, patio homes, etc., should see fairly strong price action.

Final Notes

Predicting the future direction of the market with so many variables in play is challenging. This forecast is just our take, please take caution in relying on any information provided here and consult with your real estate professional on current market conditions and expectations before taking action. If you have any questions about market conditions, would like more details specific to your neighbourhood, or for a consultation specific to your situation, please feel free to contact us anytime as we would welcome the opportunity to help.

All the best for 2019!

250.751.0804 | info@jahelkagroup.com | www.jahelkagroup.com

Sources / Referenced / Reviewed:

Central 1 Economic Analysis of British Columbia December 2018

CMHC Housing Information Portal, Nanaimo (CY) - Historical Starts by Intended Market

Ratehub.ca Mortgage Affordability Calculator

RBC Economic Research Home Resale and Price Forecast

RBC Economic Outlook December 2018

RBC Economics Research Housing Trends and Affordability

Royal LePage Market Survey Forecast

Saretzky Real Estate Month In Review December 2018

VIREB (various reports)